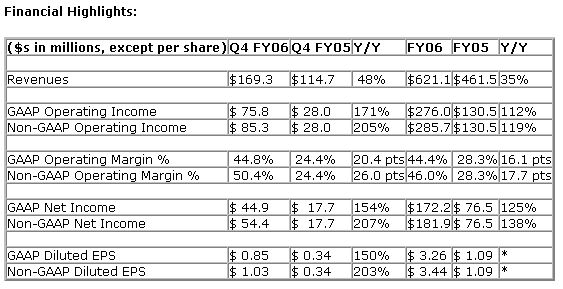

For the year ended December 31, 2006, the company achieved record revenue of $621.1 million, a 35 percent increase from $461.5 million a year ago. Net income for the year of $172.2 million was the best ever for the company, reflecting a 125 percent increase compared with last year’s net income of $76.5 million. Diluted earnings per share were $3.26 for the year. Excluding non-tax deductible, merger-related expenses of $9.7 million for the year, non-GAAP net income was $181.9 million, or $3.44 per diluted share, for the 2006 fiscal year.

“Our record-setting results for the quarter and the year reflect the success of our strategic growth initiatives and our ability to capitalize on our scaleable business model,” said Bernard W. Dan, president and CEO of the CBOT. These results were particularly rewarding given the changing dynamics in our marketplace. The financial services industry is witnessing an expansion in global access to risk management vehicles, and with that, competition among cash, futures and over-the-counter markets is intensifying."

“This past year unquestionably has been a momentous one for the CBOT, as we took important steps to strengthen our competitive position in a consolidating marketplace. Our decision to merge with CME was paramount in our efforts to secure a stronger future for the CBOT, while benefiting our market users. Other initiatives such as our move to offer electronic trading of Agricultural futures during daytime trading hours and our launch of the Asian-based commodities Exchange, JADE, lay the groundwork for future growth of the CBOT. In 2007, we will focus on serving the diverse needs of our customer base with innovative products and services while successfully completing our merger with CME.” said Dan.

The non-GAAP financial measures of operating performance exclude merger-related expenses of $9.5 million for the fourth quarter and $9.7 million for the year. The merger-related expenses are non-deductible for tax purposes, thus the pre-tax and after-tax impact is the same. Non-GAAP measures do not replace and are not superior to the presentation of our GAAP financial results but are provided to improve overall understanding of our current financial performance and our prospects for the future. * Percentage change for fiscal year EPS is not meaningful due to the company’s demutualization in second quarter of 2005.

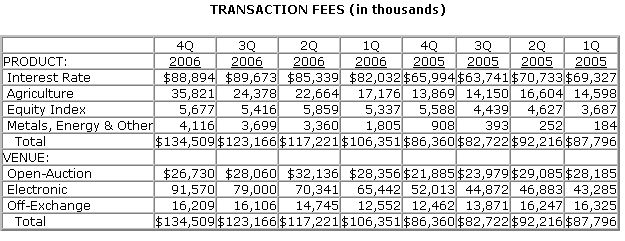

Revenue growth for the fourth quarter and the year was primarily driven by increased trading volume and higher average rates per contract, resulting in higher exchange and clearing fees. Revenue also benefited from a 33 percent increase in market data fees for the quarter and the year. The growth in market data fees was primarily generated by a market data price increase implemented January 1, 2006.

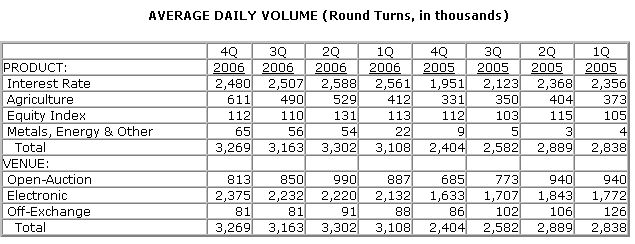

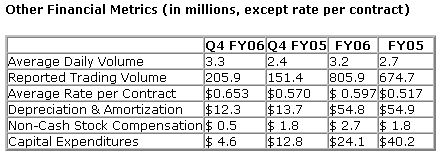

For the year, exchange and clearing fees increased 38 percent over the prior year. This growth was generated by a 19.5 percent rise in trading volume and a 15 percent increase in the average rate per contract in 2006 compared with 2005. CBOT achieved its fifth consecutive year of record-breaking volume. Trading volume for the year reached 805.9 million contracts, with volume increases across each of CBOT’s major product categories. Average daily volume (ADV) for the year ended December 31, 2006 was 3.2 million contracts, up 20 percent from the same period last year. Average daily trading volume on the CBOT’s e-cbot® electronic trading platform grew 29 percent, representing 70 percent of total exchange ADV in 2006 compared with 65 percent in 2005.

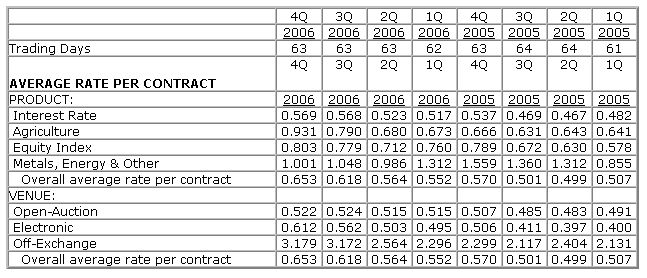

For the quarter, exchange and clearing fees increased 56 percent compared with the same period last year, reflecting a 36 percent lift in trading volume and a 15 percent increase in the average rate per contract. Trading volume for the quarter was 205.9 million contracts versus 151.4 million in last year’s fourth quarter. The average rate per contract was $0.653 for the quarter compared with $0.570 in the fourth quarter of 2005. The rate increase primarily resulted from changes in trading fees, as part of the company’s strategy to further segment its pricing structure. Additionally, the average rate per contract benefited from increased electronic trading of Agricultural contracts, resulting from the August 1, 2006, introduction of electronic trading of Agricultural futures during daytime trading hours. The average rate per contract represents total exchange and clearing fee revenue divided by total reported trading volume.

Average daily volume in the fourth quarter was 3.3 million contracts, up 36 percent compared with the 2005 fourth quarter. In addition, ADV on the CBOT’s e-cbot® electronic trading platform rose to 73 percent of total exchange ADV, up from 68 percent in the fourth quarter of 2005, reflecting strong adaptation to the side-by-side trading of Agricultural futures.

Total operating expenses for the fourth quarter were $93.5 million, up 8 percent over the prior year’s fourth quarter. Excluding merger-related expenses of $9.5 million for the quarter, operating expenses declined 3 percent compared with the prior year period. Volume-based expenses of $21.1 million rose 32 percent, in line with the growth in trading volume. Baseline and other costs, or non-volume based expenses, were $72.4 million this quarter compared with $70.7 million in the fourth quarter of 2005, a 2 percent increase.

Strong expense controls were a key driver in boosting operating margins. In the fourth quarter, operating margins expanded by more than 20 percentage points to 44.8 percent from 24.4 percent in the same period last year. Excluding merger-related expenses, the operating margin for the quarter was 50.4 percent, up 26 percentage points.

CBOT Fourth Quarter 2006 Operational Highlights

-Entered into a definitive agreement to merge with Chicago Mercantile Exchange Holdings Inc. to create the most extensive and diverse global derivatives exchange.

-Reached new record for daily trading volume, topping 7 million contracts.

-Introduced open auction trading of options on Full-sized Gold (100 oz.) and Silver (5,000 oz.) futures contracts, listing them “side-by-side” with electronic trading in the contracts to create additional trading opportunities for customers.

-Launched Dow Jones-AIG Excess Return Commodity IndexSM futures contract, which was developed at the request of market participants seeking an exchange-traded instrument that provides diverse, global commodities exposure. Subsequently, this contract became eligible for wholesale transactions.

-Implemented new process and delivery enhancements to the Metals complex, introducing an Electronic Vault Delivery Receipt system for the Precious Metals complex.

-Implemented a directed fungibility program between the Full-sized and mini-sized Agricultural futures contracts.

-Launched clearing services for two new over-the-counter (OTC) Ethanol Calendar Swap contracts, forward and previous month calendar swaps, the first exchange-cleared OTC products to be specifically tailored for use in the ethanol industry.

-Chicago Mercantile Exchange Holdings Inc. and CBOT Holdings, Inc. filed a joint proxy and registration statement on Form S-4 with the U.S. Securities and Exchange Commission relating to the proposed merger of the two companies.

Outlook

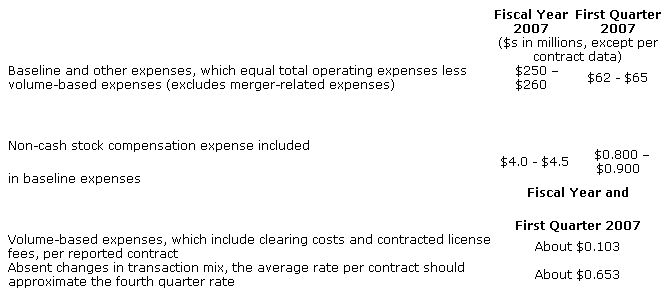

The guidance outlined below is based on the company’s current operating model as a standalone company and does not take into account merger-related expenses expected to be incurred in connection with the pending transaction between CBOT and CME. Given current market conditions and what is known today, CBOT currently expects the following for the:

The company does not provide an outlook for trading volume or revenue but does report the trading volume daily on its website at http://www.cbot.com/cbot/pub/page/0,3181,834,00.html#daily